Traditional finance has long relied on a balance sheet to measure success, yet this approach omits vast domains of value and purpose. As individuals and organizations increasingly seek deeper impact, we must explore frameworks that extend beyond simple asset and liability tallies.

By integrating new metrics, narratives, and ethical commitments, finance can become a force for holistic well-being—one that recognizes the myriad forms of wealth that shape our world.

A balance sheet provides a “snapshot” of assets, liabilities, and equity at a specific moment, but it fails to convey ongoing transformation, emerging risks, or human dimensions. Numbers alone cannot reveal environmental stewardship, community trust, or individual health.

While these statements excel at quantifying tangible elements, they overlook the true scope of value and fail to capture human impact that underpin lasting prosperity.

Relying solely on profit and asset accumulation can blind decision-makers to opportunities and hazards, generating false confidence and a narrow definition of success.

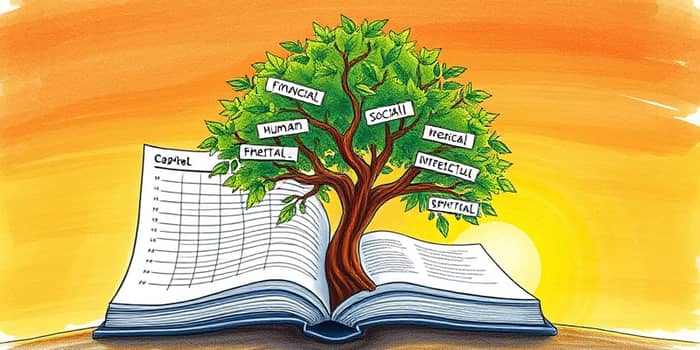

To transcend numeric reductionism, experts propose five distinct but interrelated capitals. By balancing these dimensions, individuals and firms craft strategies aligned with broader life goals and societal progress.

Some advisors now champion approaches like Net Worthwhile®, ensuring that financial choices fuel personal growth, community ties, and lasting impact, not just numerical gains.

Modern organizations recognize that customers, employees, suppliers, communities, and investors align best when united by a clear purpose. This collective focus often proves more valuable than any single line on a balance sheet.

Intangible investments—brand equity, intellectual property, organizational culture—often exceed tangible holdings by more than two to one. Yet these assets remain largely invisible in traditional reporting, leaving markets ill-equipped to reward long-term vision.

For example, United Kingdom startups invest twice as much in intangible development but struggle to secure IPO capital because these efforts lack transparent valuation. Neglecting such assets is estimated to cost UK businesses over £100 billion per year.

Case in point: long-term shareholders at Volkswagen once enabled management to sideline ethical concerns, illustrating how misaligned incentives can undermine corporate integrity and stakeholder trust.

Finance is evolving from compliance-driven sheets to rich narratives that articulate strategy, risks, and social impact. Forward-looking firms publish integrated reports combining:

• Non-financial metrics—ESG performance, sustainability targets, employee engagement.

• Management commentary—contextualizing numbers with strategic priorities and market outlooks.

• Stakeholder disclosures—tailored insights for regulators, customers, communities, and employees.

Regulators are also shifting: the UK Financial Services Authority eliminated mandatory quarterly reporting in 2014 to encourage longer-term decision-making, while global bodies demand greater transparency and accountability.

True legacy planning transcends bequeathing financial holdings. It embraces an integrated wealth-and-heritage planning model, safeguarding human capital through education, nurturing social capital via community involvement, and preserving spiritual capital through shared values.

The most enduring inheritance comprises hearts, minds, and relationships that outlast any portfolio. By cultivating purpose-driven conversations across generations, families can ensure their collective story and impact endure.

Translating theory into practice requires intentional design. Consider these steps to cultivate meaning alongside money:

Transparent reporting supports robust risk management, from anti-fraud measures to liquidity planning. Building detailed disclosures fosters trust among stakeholders and equips decision-makers with real-time clarity on financial health.

Finally, embrace integrated thinking: combine hard data with soft insights to unlock opportunities that remain invisible on a ledger yet fundamental to enduring success.

The balance sheet remains a vital tool, but it alone cannot capture the breadth of true wealth. By expanding our gaze to include human, intellectual, social, and spiritual capitals—and by weaving narrative and purpose into our reports—we create finance that fuels holistic progress.

Ultimately, cultivating meaning in finance is not a luxury; it is the blueprint for resilient organizations, thriving communities, and lives rich in purpose. As we move beyond the balance sheet, we chart a path toward value creation that resonates in boardrooms and living rooms alike.

References